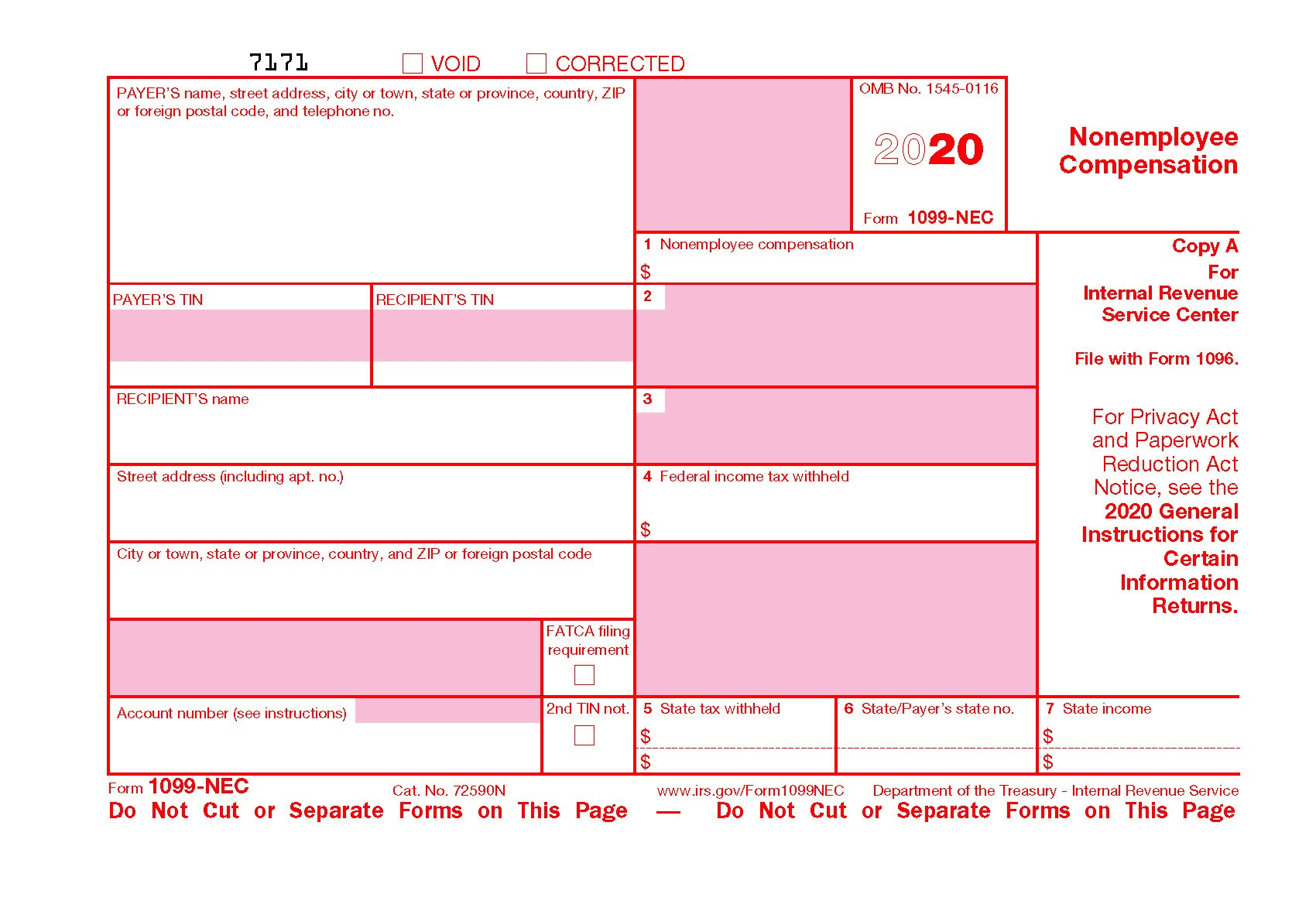

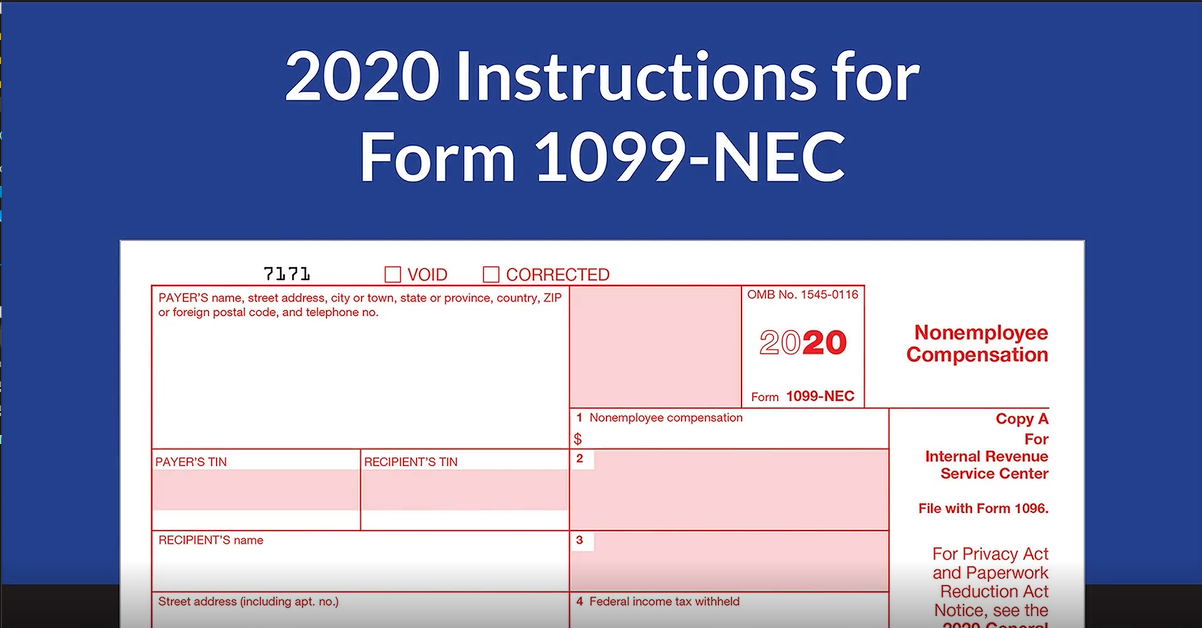

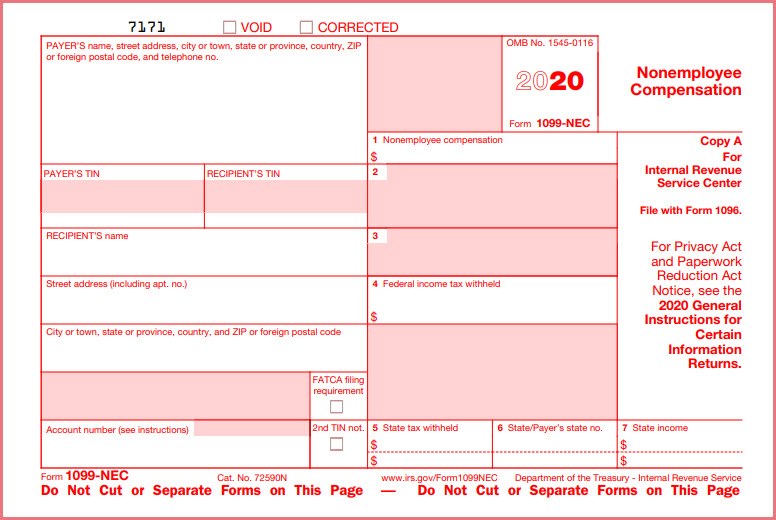

Scannable, but the online version of it, printed from this website, is not Do not print and Instructions for Certain Information Returns, available atForm 1099NEC, Nonemployee Compensation Form 1099NEC is used by payers to report payments of $600 or more made in the course of a trade or business to others for services Prior to , these payments were reported in box 7 on Form 1099MISC Payers must provide a copy of 1099NEC to the independent contractor by January 31 of the year following payment Payments reported as nonemployee0221 · If you received the Form 1099NEC for a nonemployee compensation, you should enter the information in both Form 1099NEC and Schedule C sections I will suggest you to add the Schedule C See below for instructions You would start from the 1099NEC section under "1099MISC and Other Common Income" You would then follow prompts to tell the

Form 1099 Nec Released For The Filing Year Berntson Porter Company Pllc

How to file 1099 misc nonemployee compensation

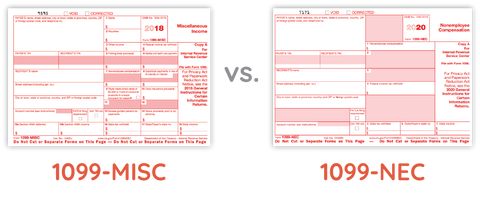

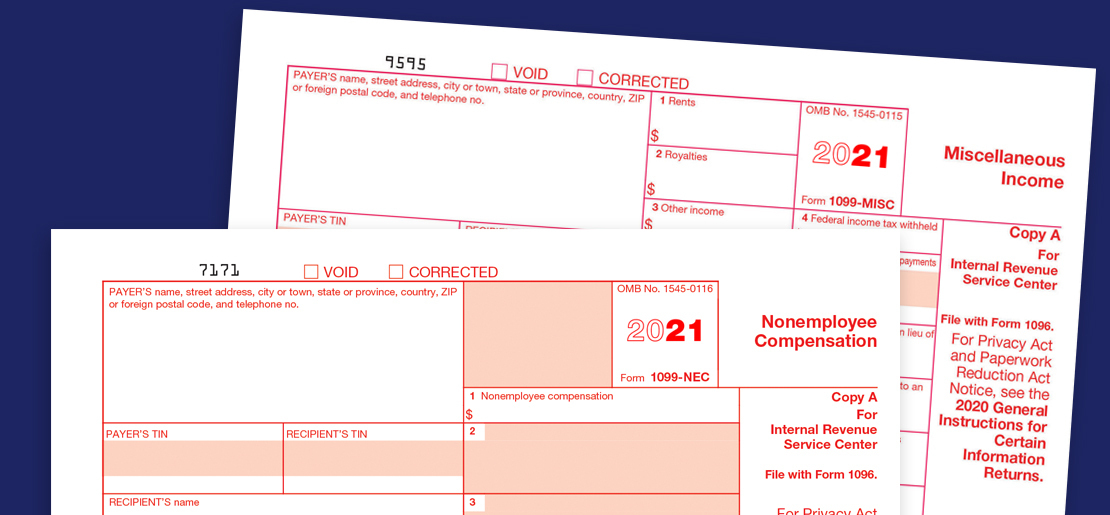

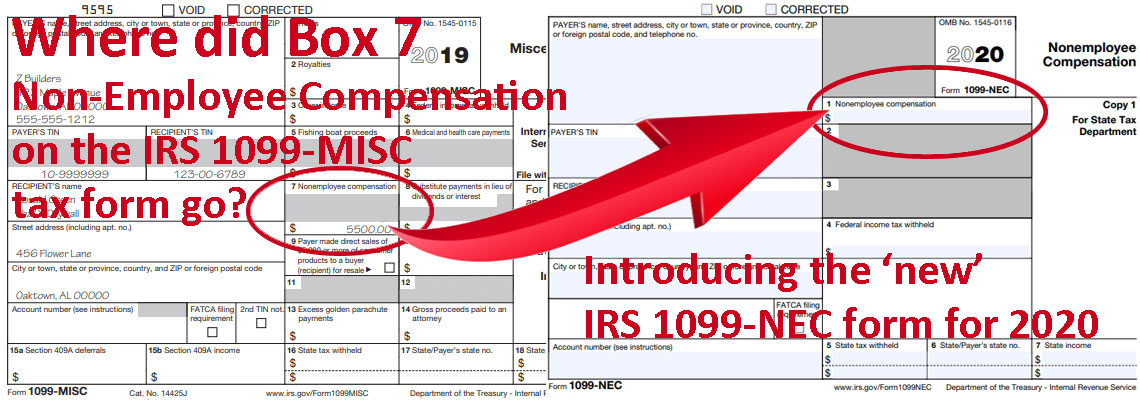

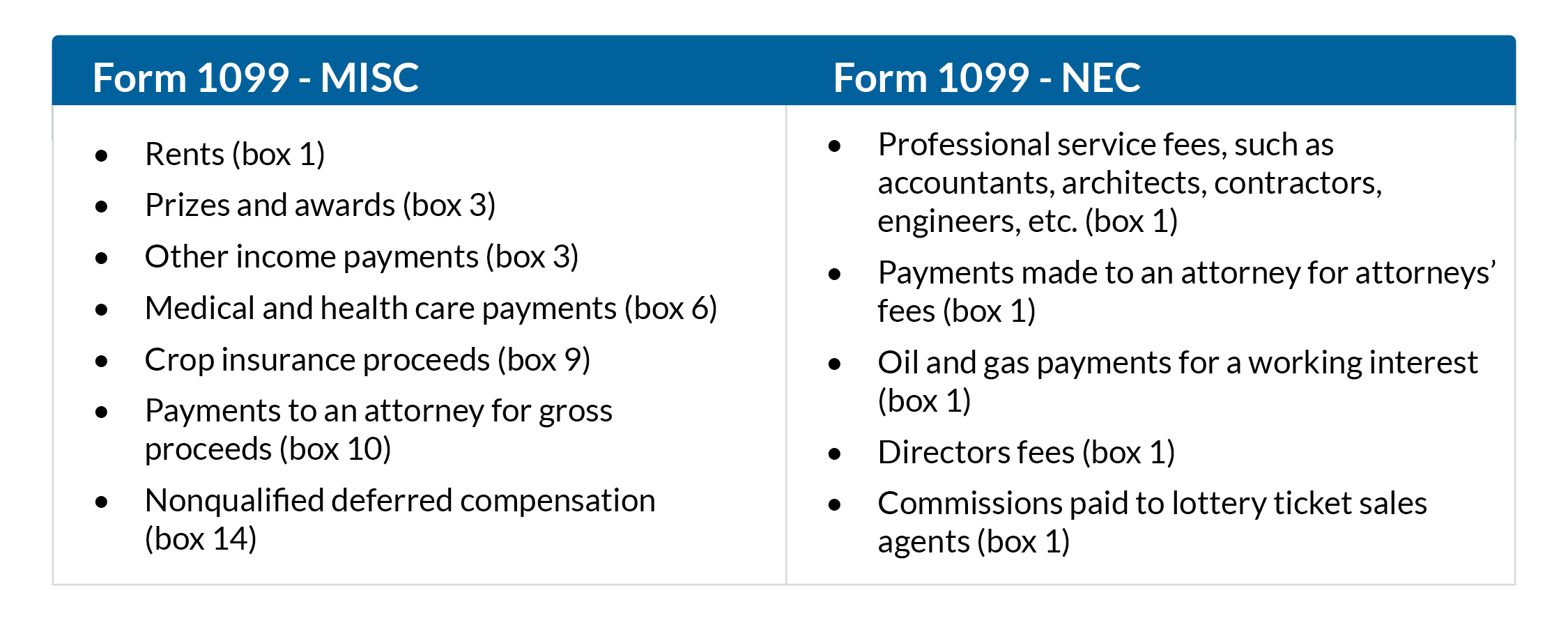

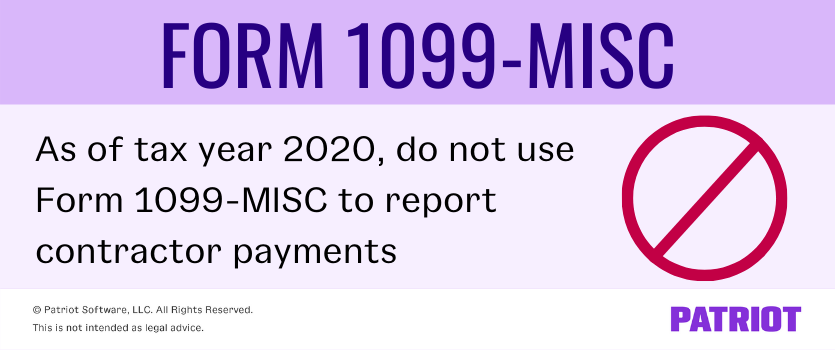

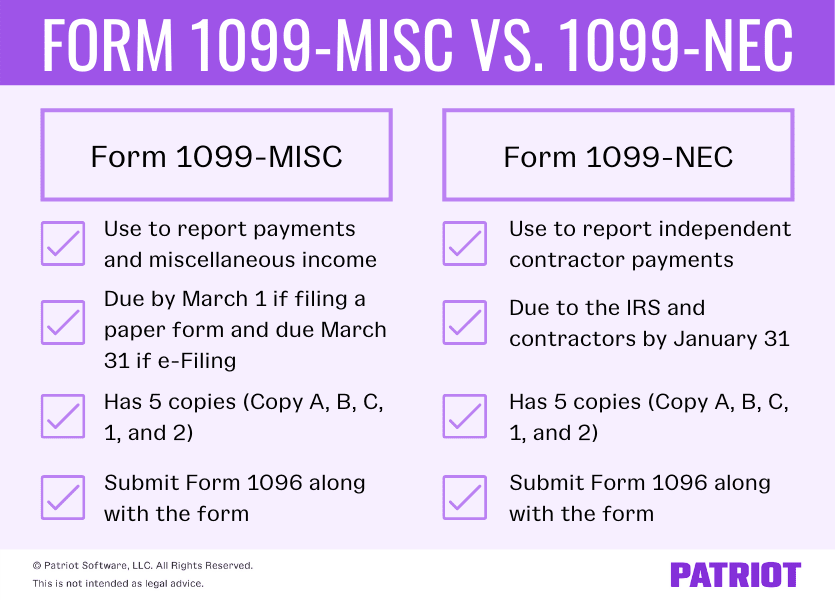

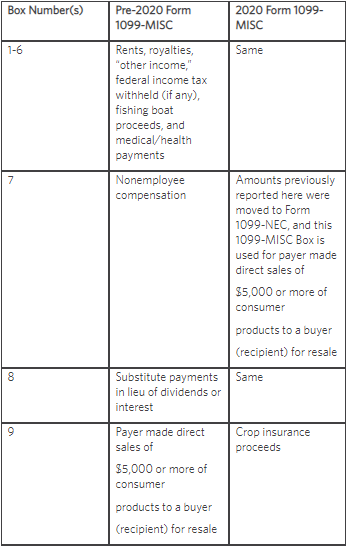

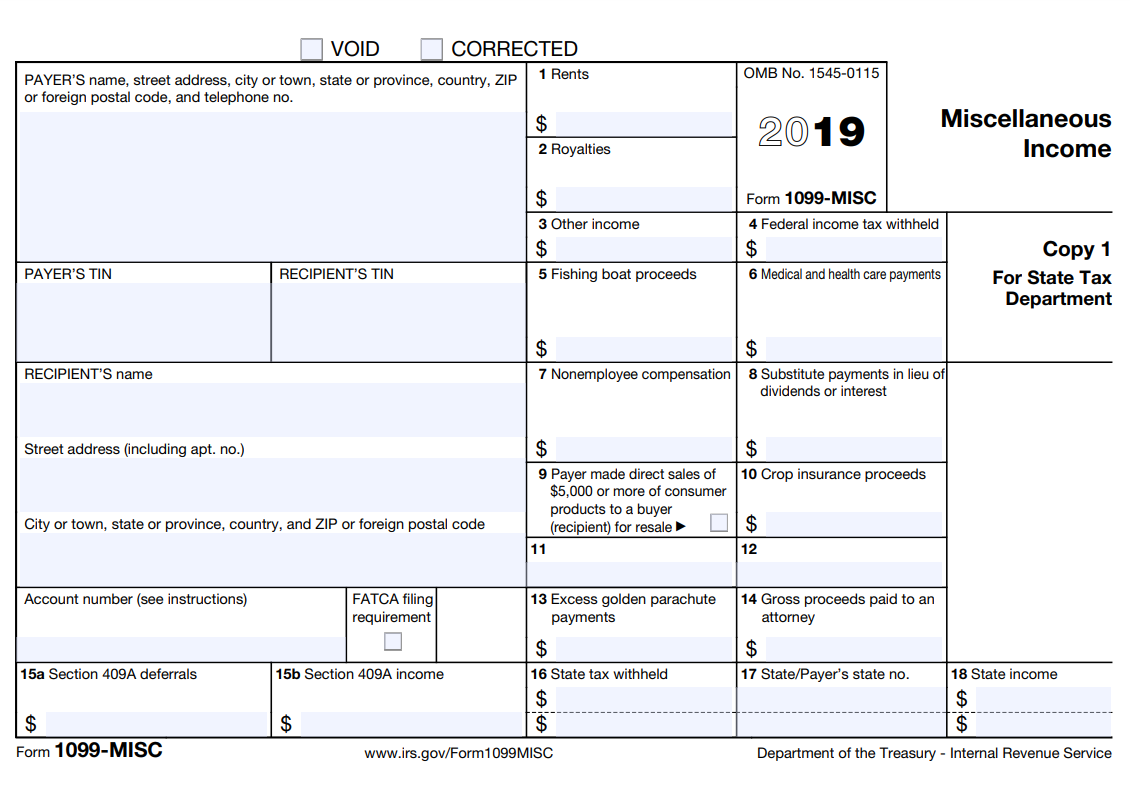

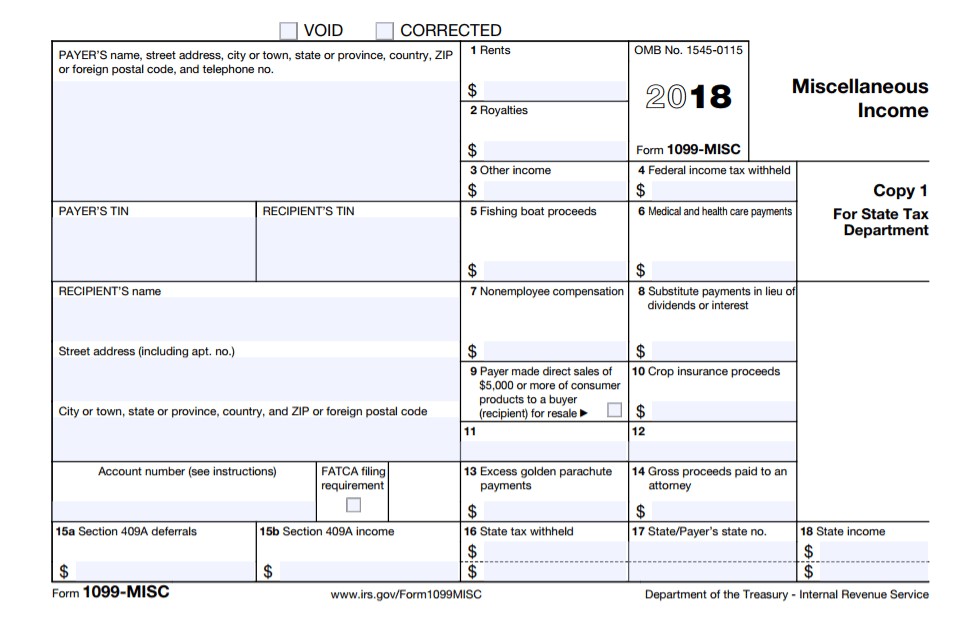

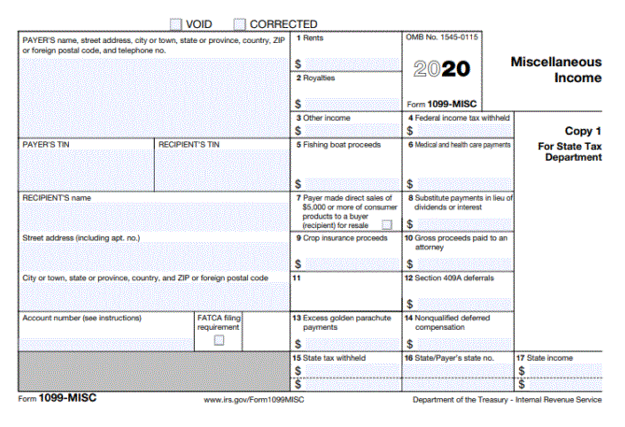

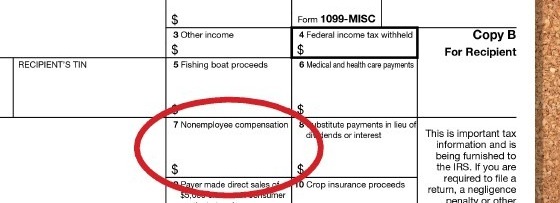

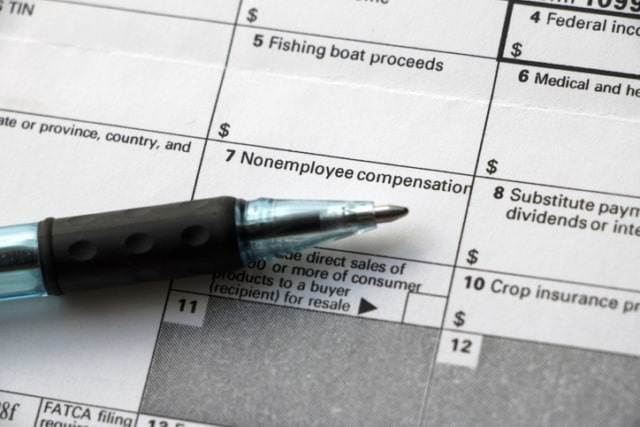

How to file 1099 misc nonemployee compensation-0421 · Here are the key differences between tax forms 1099NEC and 1099MISC If you were selfemployed in , you may have received Form 1099NEC, Nonemployee Compensation, instead of Form 1099MISC2904 · Beginning with tax year , nonemployee compensation will no longer be reported in Box 7 of the 1099MISC form Instead, all nonemployee compensation must now be reported on a separate Form 1099NEC

:max_bytes(150000):strip_icc()/Form1099-NEC-46cc30fa3f2646d8be4987b14d4aa5d4.png)

Form 1099 Nec What Is It

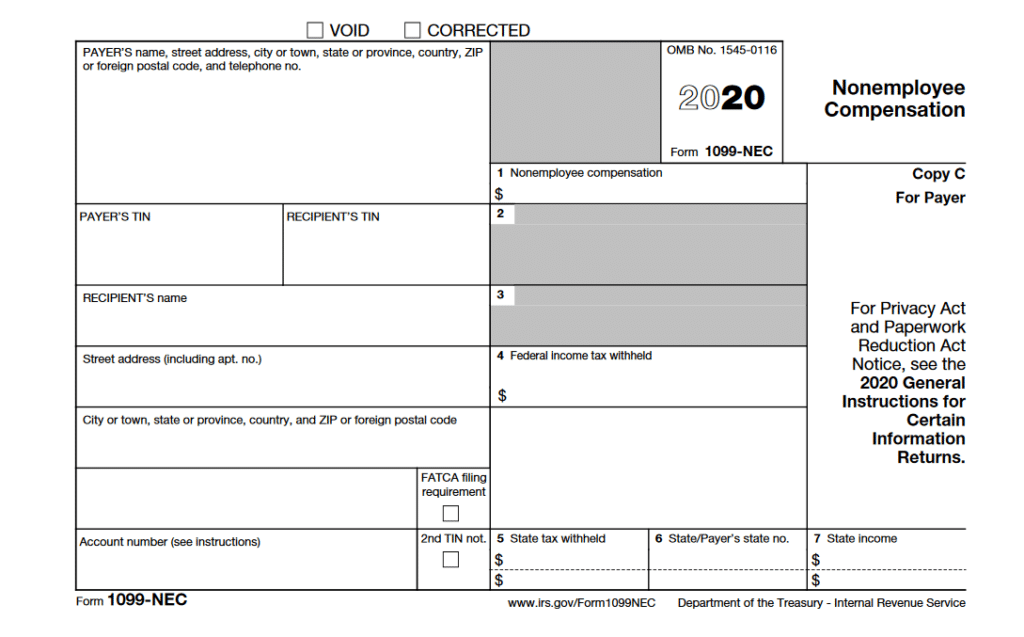

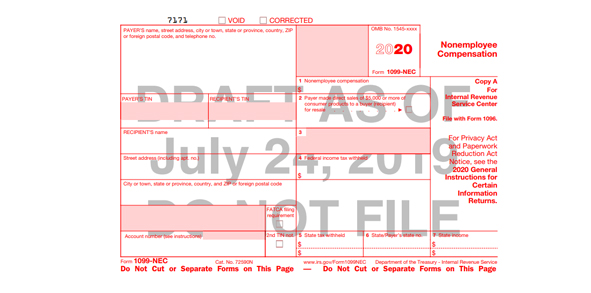

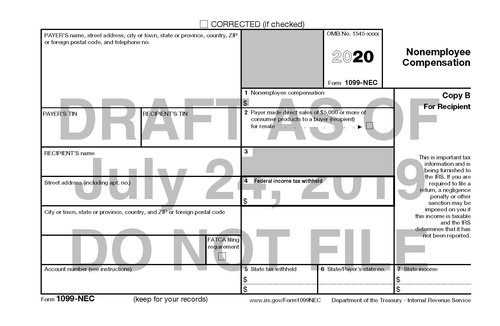

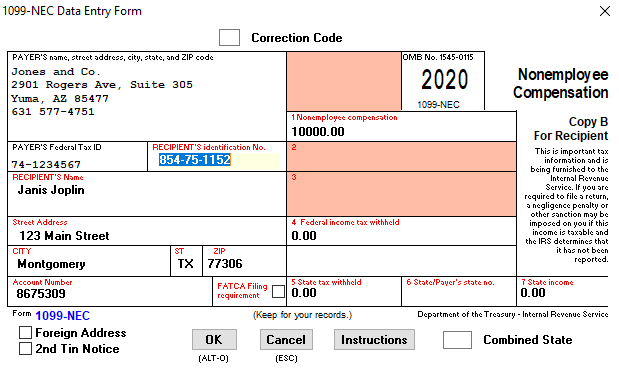

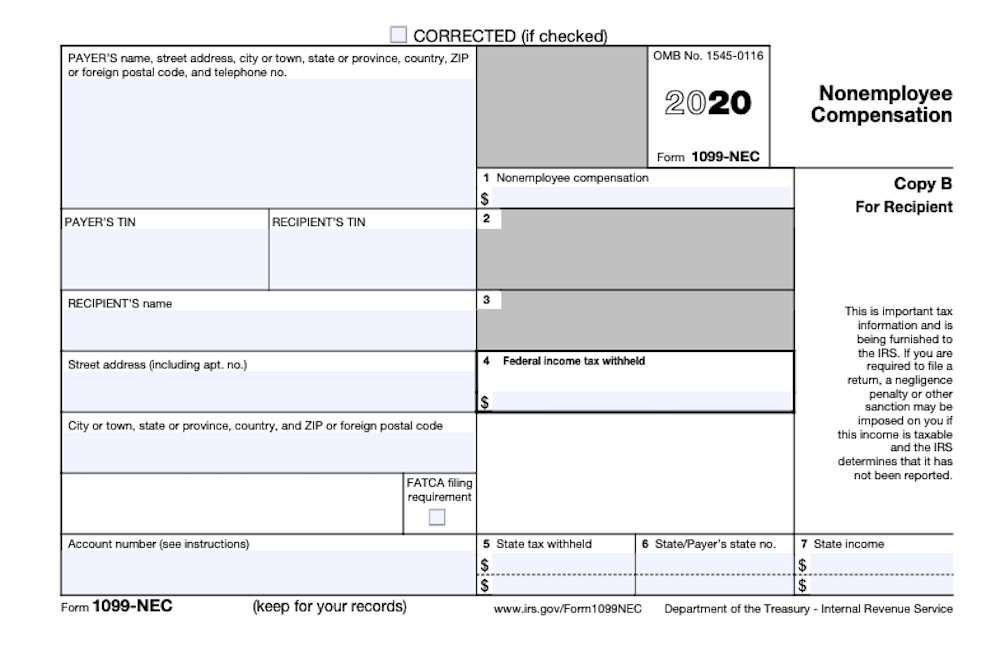

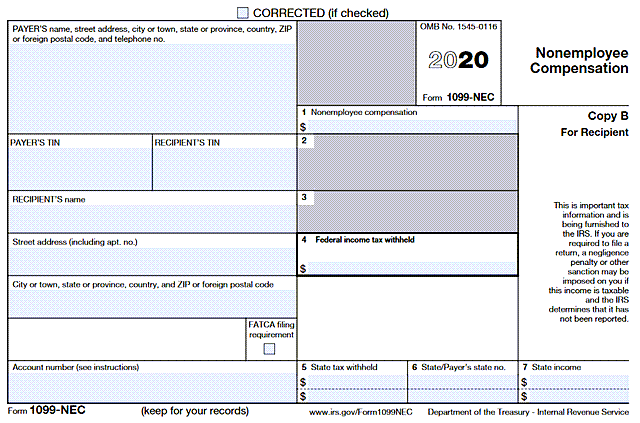

The IRS has recently released a draft of a new form, Form 1099NEC, which will be used to report payments for Nonemployee Compensation paid in Payments made prior to have previously been made using Form 1099MISC, box 7, Nonemployee Compensation (NEC) This new Form 1099NEC will only be used for reporting Nonemployee Compensation, while the 10991510 · Prior to tax year , nonemployee compensation was reported in Box 7 on Form 1099MISC However, with the passing of the Protecting Americans from Tax Hikes (PATH) Act in 15, the due date for reporting amounts in Box 7 was accelerated to Jan 31, while the deadline for reporting most other information on Form 1099MISC remained at Feb 28, if filing on paper,Missing IRS Form 1099 Deadline leads to huge penalties File 1099 Misc by the end of January 31st, Send 1099 Misc Form to the IRS as well as to the Recipient The Payer Details For the 1099 NE C Reporting Form Online filing process, you should fill the form with the business owner or the payer details They are the legal name, valid

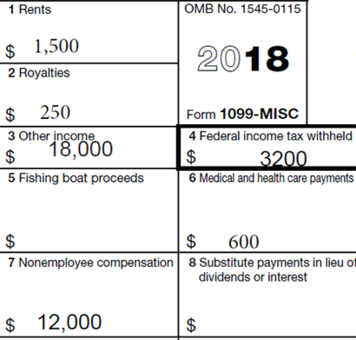

03 · Form 1099NEC (previously retired in 19) replaces Box 7 of the pre Form 1099MISC for reporting nonemployee compensation and accelerates the due date for reporting nonemployee compensation · Nonemployee compensation reported in Box 7 of 1099MISC has to be reported in a new form, Form 1099NEC for the tax year To accommodate this change, Form 1099MISC has been revised and a new form has been introducedForms 1099MISC, Miscellaneous Income & 1099NEC, Nonemployee Compensation November To assist businesses in filing nonemployee compensation by January 31 and other 1099 reportable payments by February 28 (or March 31 if filing electronically), the IRS created new Form 1099NEC, required starting in Both forms must be furnished to recipients by

1812 · For reference, the IRS defines nonemployee compensation in the Instructions for Forms 1099MISC and 1099NEC () as the following If a payment meets these four conditions, it should generally be reported on the1099NEC You made the payment to someone who is not your employee You made the payment for services in the course of your trade or2311 · Nonemployee compensation for years has been reportable on line 7 of Form 1099MISC, but beginning with forms, filers instead will report nonemployee compensation on Form 1099NEC This change, we are told, is designed to "increase compliance" Unlike the catchall that is Form 1099MISC, Form 1099NEC is a singleuse form, reporting only nonemployee compensationExpenses, which are either incurred, paid, or expected to be incurred later on Nevertheless,

1099 Misc 1099 Express

How To Read Your 1099 Justworks Help Center

January 30, August 2, · Others by Loha Leffon IRS Form 1099 Nonemployee Compensation – What exactly are 1099 Forms?If you received a Form 1099MISC Miscellaneous Income instead of a Form W2 Wage and Tax Statement, the income you received is considered nonemployee compensation or selfemployment income Selfemployed status means that the company or individual you worked for didn't withhold income tax or Social Security and Medicare tax As a result, you'll need to complete Schedule C (Form1502 · Form 1099NEC essentially replaces box 7 (labeled nonemployee compensation) on form 1099MISC Subsequently, box 7 on form 1099MISC for tax year has been removed Actually, this new form was an old form that has not been in use since 19 Because there were separate filling dates for box 7 on the 1099MISC and the other types of compensation reported on form 1099MISC

Introducing The New 1099 Nec For Reporting Nonemployee Compensation Asap Accounting Payroll

1099 Misc Nonemployee Compensation Is Now Form 1099 Nec Blue Summit Supplies

· To know the Federal 1099 NEC Form and to File 1099 NEC Online, visit our website You will get the complete details about IRS Tax Form 1099 NEC and the filing procedure 1099 Misc Online What is NEC?Form 1099NEC Nonemployee Compensation An entry in Box 7 for nonemployee compensation would usually be reported as selfemployment income on Schedule C Profit or Loss from Business The payer of the miscellaneous income did not withhold any income tax or Social Security and Medicare taxes from this miscellaneous income2710 · While the new Form 1099NEC is required to report nonemployee compensation starting with the tax year, any prior year's reporting (ie before ) will need to be reported on the Form 1099MISC

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Irs 1099 Misc Vs 1099 Nec Inform Decisions

· If you filed 1099MISC with only Box 7 in the past you should most likely choose Box 1 Nonemployee Compensation on the 1099NEC This is the most common situation and the only box most businesses will need to select for payment types If you have other payment types, you'll need to file both forms1609 · If you are currently using box 7 on the 1099MISC form, you will have to move that info to box 1 on the 1099NEC to report nonemployee compensation for Payments of $600 or more to a service provider will be captured by the new form Employers must use the form for work done by an independent contractor, including vendors, consultants, freelancers, landscapers,Form 1099NEC was an active form until 19, it is now returning to the spotlight for tax year The IRS relaunched 1099NEC because of the confusion in the deadline to file 1099MISC with nonemployee compensation Until 15, the deadline to file 1099 MISC with nonemployee compensation and other miscellaneous payments was February 28

Printable Form 1099 Misc 21 Insctuctions What Is 1099 Misc Tax Form

1099 Misc Form Copy B Recipient Discount Tax Forms

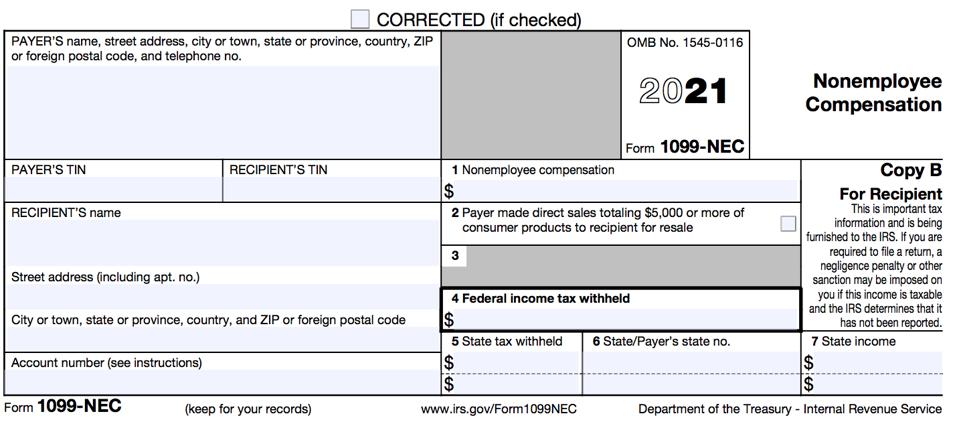

Beginning with the tax year, the IRS will require business taxpayers to report nonemployee compensation on the new Form 1099NEC instead of on Form 1099MISC Businesses will need to use this form if they made payments totaling $600 or more to a nonemployee, such as an independent contractor If you are selfemployed,0505 · Form 1099NEC will replace Form 1099MISC for reporting nonemployee compensation beginning with the tax year This means that for the 21 tax season, businesses will need to file Form 1099NEC to report nonemployee compensation paid during theThe January 31 filing deadline applies only to Form 1099MISC with an amount in Box 7 (nonemployee compensation) The filing due date for other Forms 1099 not reporting nonemployee compensation remains February 28, 19 if filing by paper, and March 31, 19 if filed electronically

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

1099 Nec Form Copy B C 2 3up Discount Tax Forms

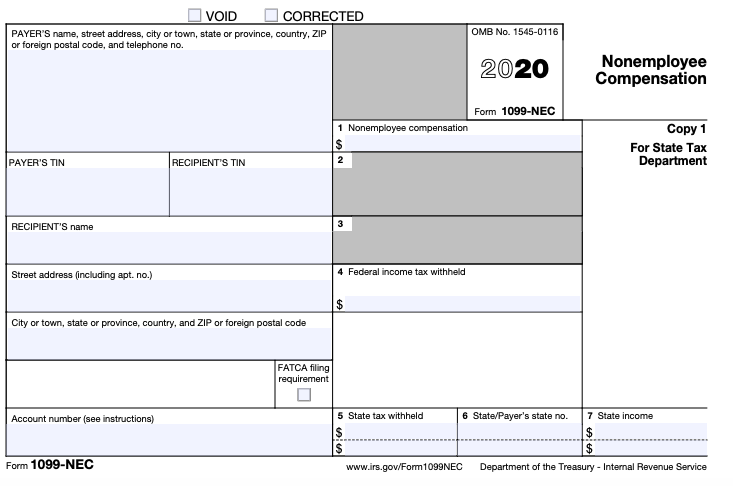

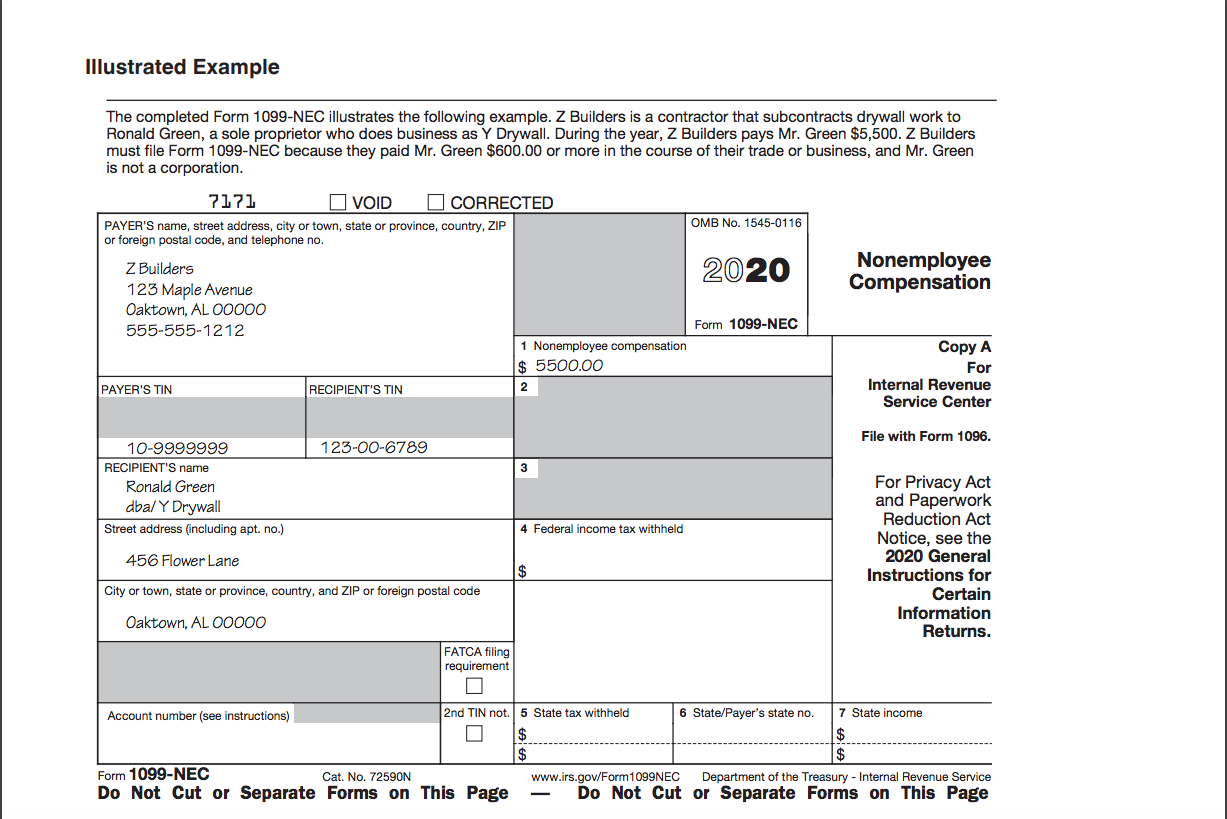

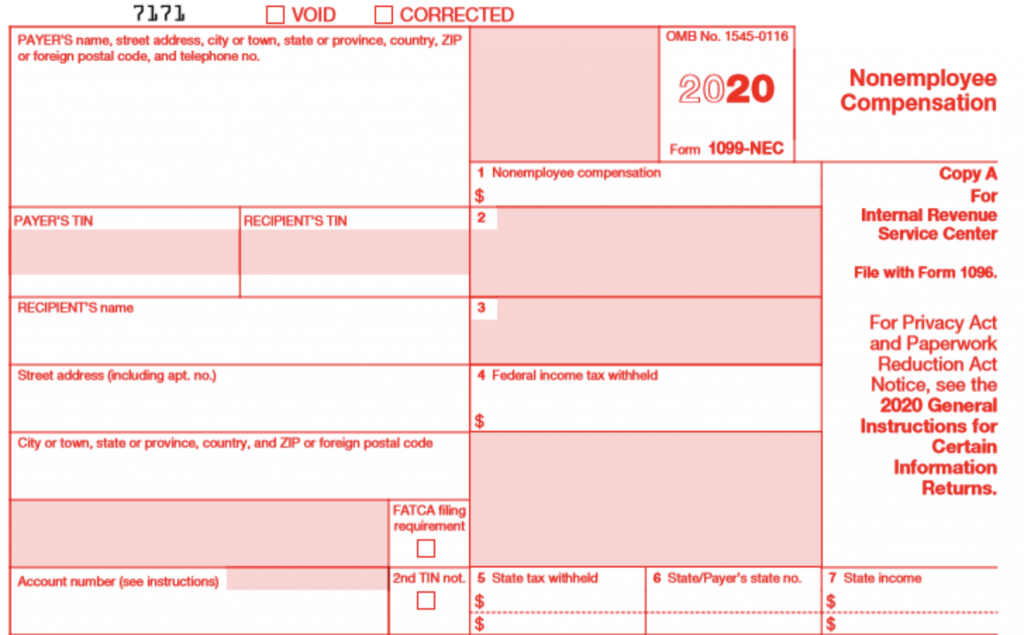

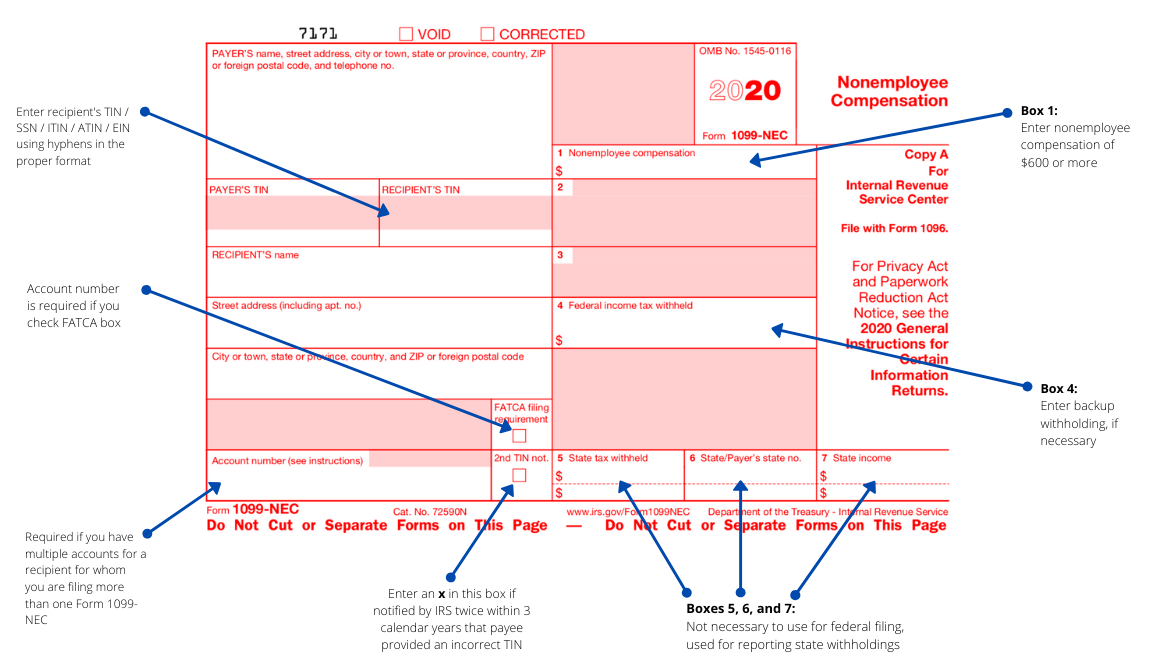

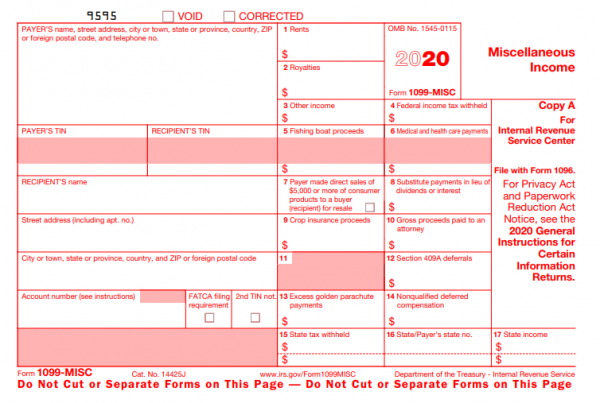

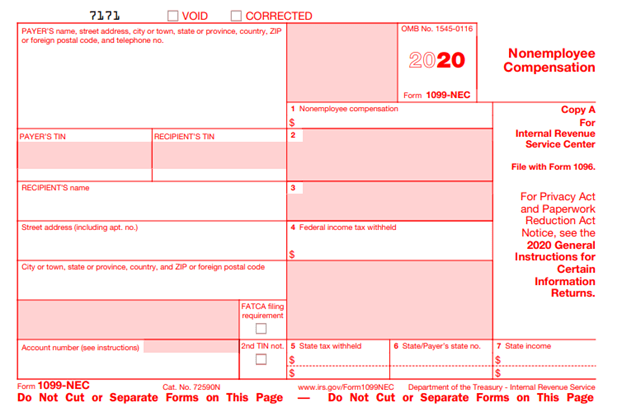

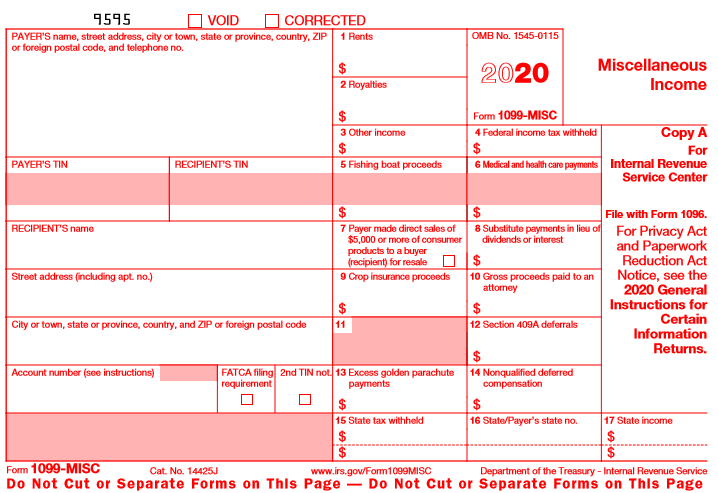

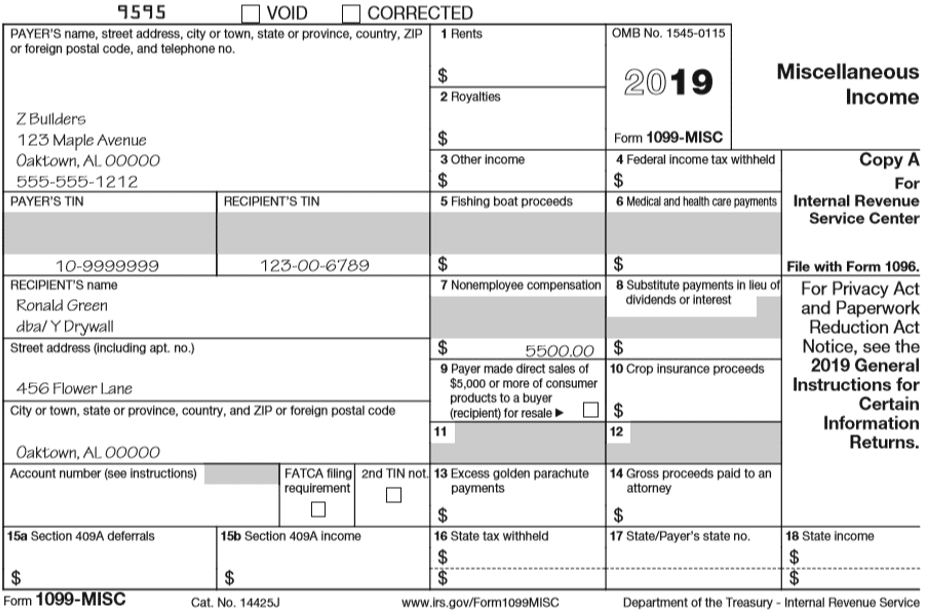

Form 1099NEC Cat No N Nonemployee Compensation Copy A For Internal Revenue Service Center Department of the Treasury Internal Revenue Service File with Form 1096 OMB No For Privacy Act and Paperwork Reduction Act Notice, see the General Instructions for Certain Information Returns 7171 VOID CORRECTEDNonemployee compensation reporting has removed from the 1099MISC Tax Form for The major change is Box 7, which previously used for reporting nonemployee compensation Now, Box 7 used for direct sales of $5,000 or more Other information on the form has been reassigned to different box categoriesPrior to , payers completed form 1099MISC to report nonemployee compensation of $600 or more in box 7 Form 1099MISC has been redesigned and no longer includes employee compensation Instead, the IRS reintroduced form 1099NEC to simplify the deadline among other things The 1099NEC Form shown at right reports the payments made to nonemployees on box 1 Who must file Form 1099

Form 1099 Nec Is Making A Come Back

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

IRS provides a 1099NEC Form for reporting nonemployee payments like contractor and selfemployed payments For the tax period, the payer must use the 1099NEC Form for reporting nonemployee payments Before reintroducing IRS 1099NEC Tax Form, business owners who recruit contract employees use 1099Misc Box 7A new 1099NEC form has been introduced by the IRS for It is actually an old form that hasn't been in use since 19 Prior to , organizations could file one Form 1099MISC to report nonemployee compensation and miscellaneous income items by February 28 each year · Nonemployee compensation is the payment you pay to 1099 form an independent contractor who performs service for you Nonemployee compensation covers fees, commissions, prizes, and awards for services Payer will consider nonemployee compensation differently than employee wages Payer does not withhold taxes for an independent contractor because

Irs To Reinstate Form 1099 Nec Requests Comments On Draft

Irs Introduces New 1099 Nec Form To Report Nonemployee Compensation

2409 · The new 1099NEC is really just Box 7 removed from the 1099MISC form, and given it's own personal document Just be sure you know which items you will report on both forms Lucky for you, the forms come with instructions, in case you have any doubt Now, just keep going with the flow of , and hopefully you'll arrive in tax season and the new year ready for someForm 1099NEC as nonemployee compensation Any amount included in box 12 that is currently taxable is also included in this box This income is also subject to a substantial additional tax to be reported on Form 1040, 1040SR, or 1040NR See the Instructions for Forms 1040 and 1040SR, or the Instructions for Form 1040NR Boxes 15–17If you are inside a hurry, right here is the fundamental gist What's noted on the 1099 Form Income, which is both earned and paid out;

Form 1099 Nec Vs 1099 Misc For Tax Year Blog Taxbandits

How To Use The New 1099 Nec Form For Dynamic Tech Services

2709 · If you're accustomed to filing Form 1099MISC to report nonemployee compensation, you'll need to reorder your IRS alphabet for your returns The government is now bringing back Form 1099NEC for that purpose, a form that was last used in 19, during the Reagan administration The 1099NEC is being reintroduced to address confusion created by the1307 · Beginning with reporting for the tax year, nonemployee compensation (NEC) will be reported in box 1 of Form 1099NEC (Nonemployee Compensation) For 19 and prior years, NEC is reported in box 7 of Form 1099MISC (Miscellaneous Income) Statements to Recipients If Form 1099NEC is required to be filed, the recipient must be furnished a · You can no longer report nonemployee compensation in Box 7 of Form 1099MISC If you want to report nonemployee compensation, you will have to file Form 1099NEC Simplify Your Form 1099MISC Online Filing with ExpressEfile!

Self Employed Vita Resources For Volunteers

1099 Nec And 1099 Misc Changes And Requirements For Property Management

0607 · There is a new Form 1099NEC, Nonemployee Compensation for business taxpayers who pay or receive nonemployee compensation Starting in tax year , payers must complete this form to report any payment of $600 or more to a payee Generally, payers must file Form 1099NEC by January 31 For tax returns, the due date is February 1, 211, accelerated the due date for filing Form 1099 that includes nonemployee compensation (NEC) from February 28 to January 31 and eliminated the automatic 30day extension for forms that include NEC Beginning with tax year , use Form 1099NEC to report nonemployee compensation See part C in the General Instructions for CertainThe Nonemployee Compensation is also called as self–employment income If you are working individually without taking any equipment from the

Irs Launches New Form Replacing 1099 Misc For Wicz

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

· New IRS Form 1099NEC, Nonemployee Compensation, for Payments By John Brant, Tax Manager and Krista Picone, Tax Supervisor The IRS has recently released a draft of a new form, Form 1099NEC, which will be used to report payments for Nonemployee Compensation paid in Payments made prior to have previously been made using Form 1099MISC, box 7, Nonemployee Compensation2511 · IRS Form 1099NEC Overview Updated on November 25, 1030 AM by Admin, ExpressEfile Team The IRS has introduced Form 1099NEC again, after 19, in order to avoid the confusion in deadlines for filing Form 1099MISC Form 1099NEC must be filed to report nonemployee compensation paid in a year, which has been reported in Box 7 of 1099 · New Form 1099NEC The IRS has made big changes to the 1099MISC form by reviving the 1099NEC form Beginning with the tax year (to be filed by February 1, 21) the new 1099NEC form will be used for reporting nonemployee compensation (NEC) payments Previously NEC was reported in Box 7 of the 1099MISC form

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Form 1099 Nec Released For The Filing Year Berntson Porter Company Pllc

1102 · Forms reporting nonemployee compensation have to be filed with the IRS by January 31, whereas Forms 1099MISC that don't report nonemployee compensation are still subject to the later February 28 (for paper filings)/March 31 (for electronic filings) deadline One form with two filing deadlines is admittedly confusing2309 · If you're accustomed to filing Form 1099MISC to report nonemployee compensation, you'll need to reorder your IRS alphabet for your returns The government is now bringing back Form 1099NEC0701 · 1099 Misc Form Nonemployee Compensation If payment for services you provided is listed in box 1 of Form 1099 NEC Payment for recipient services is called nonemployee compensation 1099 NEC Form is used to report nonemployee compensation

Form 1099 Nec For Nonemployee Compensation H R Block

How Has Form 1099 Misc Changed With The Return Of Form 1099 Nec

Irs Form 1099 Misc Irs Form 1099 Nec Lancaster Cpa Firm

1099 Misc Nonemployee Compensation Is Now Form 1099 Nec Blue Summit Supplies

:max_bytes(150000):strip_icc()/Form1099-NEC-46cc30fa3f2646d8be4987b14d4aa5d4.png)

Form 1099 Nec What Is It

How To Add 1099 Nec To Your Sage 100 Tax Forms

Is Your Business Prepared For Form 1099 Changes Rkl Llp

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

New Form 1099 Nec Replaces 1099 Misc For Reporting Non Employee Compensation For Boyer Ritter Llc

How To Fill Out Form 1099 Misc Reporting Miscellaneous Income

Filing Form 1099 Nec Beginning In Tax Year Leone Mcdonnell Roberts Professional Association Certified Public Accountants

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Form 1099 Misc Vs 1099 Nec Differences Deadlines More

How Will 1099 Misc Reporting Be Different Carr Riggs Ingram

Irs Releases Form 1099 Nec Why The Fuss Grennan Fender

Use Form 1099 Nec To Report Non Employee Compensation In

Businesses Have Feb 1 Deadline To Provide Forms 1099 Misc And 1099 Nec To Recipients Mychesco

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

New Form 1099 Nec Non Employee Compensation Virginia Cpa

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

Irs To Bring Back Form 1099 Nec Last Used In 19 Current Federal Tax Developments

Hhm

1099 Nec A New Way To Report Non Employee Compensation

New Irs Form 1099 Nec Takes Non Employee Compensation Out Of Misc Tax Practice Advisor

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

1099 Misc Public Documents 1099 Pro Wiki

The Irs Resurrects Form 1099 Nec After A 38 Year Absence

:max_bytes(150000):strip_icc()/IncomepaymentsonForm1099-d3a58e7252144573a1aeb1f330feb73c.jpg)

Income Payments On Form 1099 What Are They

Amazon Com 1099 Nec And 1099 Misc 4 Part Tax Forms Combo Kit For All Non Employee Compensation Filing Self Seal Envelopes Included Quickbooks And Other Software Compatible Office Products

Irs Form 1099 Misc Irs Form 1099 Nec Lancaster Cpa Firm

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Microsoft Dynamics Gp Year End Update Payables Management Form Changes Including The New 1099 Nec Microsoft Dynamics Gp Community

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

1099 Nec Or 1099 Misc What Has Changed And Why It Matters Issuewire

1099 Misc Form Copy A Federal Discount Tax Forms

Form 1099 Nec Nonemployee Compensation 1099nec

Nonemployee Compensation Reportable On Revived Form 1099 Nec For Payments Lexology

1099 Nec 1099 Express

What Is Form 1099 Nec

Quickbooks 1099 Tax Form Changes At Year End Insightfulaccountant Com

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc It S Your Yale

1099 Misc Nonemployee Compensation Is Now Form 1099 Nec Blue Summit Supplies

Amazon Com 1099 Nec And 1099 Misc 4 Part Tax Forms Combo Kit For All Non Employee Compensation Filing Self Seal Envelopes Included Quickbooks And Other Software Compatible Office Products

1099 Nec Form Copy B Recipient Zbp Forms

T33jd0pwcbpmtm

Changes In 1099 Reporting For Tax Year Form 1099 Nec

Form 1099 Nec Instructions And Tax Reporting Guide

Acumatica 1099 Nec Reporting Changes Crestwood Associates

:strip_icc()/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

1099 Misc Form Copy C 2 Payer State Discount Tax Forms

1099 Nec Form Copy B 2 Discount Tax Forms

Irs Tax Form 1099 Nec What It Is And What You Need To Know To Use It Blog For Accounting Quickbooks Tips Peak Advisers Denver

Need To File 1099 Misc For 18 What You Need To Know S J Gorowitz Accounting Tax Services P C

1099 Rules For Business Owners In 21 Mark J Kohler

Form 1099 Misc Vs Form 1099 Nec How Are They Different

Your Ultimate Guide To 1099s

Memo For 1099 Nec Replaces 1099 Misc For Nec Non Employee Compensation Chris Whalen Cpa

Umm Maybe I Forget To Start Using The 1099 Nec Form And Boxes Umm Help Sage X3 Support Sage X3 Sage City Community

Form 1099 Nec Instructions Reporting Non Employee Compensation For Taxbandits Youtube

Irs Introduces New Ish Form To Replace Parts Of Form 1099 Misc Taxgirl

Form 1099 Nec Officially Replaces 1099 Misc For Reporting Payments To Nonemployees Salt Lake City S Cpa S

Introducing The New 1099 Nec For Reporting Nonemployee Compensation Asap Accounting Payroll

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

Form 1099 Nec Or Form 1099 Misc Delano Sherley Associates Inc

Form 1099 Nec Nonemployee Compensation 1099nec

Send A New Form 1099 Nec To The Ftb Windes

1099 Nec Or 1099 Misc What Has Changed And Why It Matters Pro News Report

Transitioning From The 1099 Misc To The 1099 Nec Form How Does This Impact You

Isjo3fcy4zjf M

Change To 1099 Form For Reporting Non Employee Compensation Ds B

1099 Misc Form Fillable Printable Download Free Instructions

Due Soon New Form 1099 Nec And Revised 1099 Misc The Cpa Desk

Information Reporting Reminders Bkd Llp

Quickbooks 1099 Tax Form Changes At Year End Insightfulaccountant Com

Form 1099 Nec Reporting Nonemployee Compensation Albin Randall And Bennett

0 件のコメント:

コメントを投稿